With the Bitcoin halving event just 73 days away, the cryptocurrency community is buzzing with speculation, analysis, and a keen interest in understanding the implications of this significant occurrence. Bitcoin halving doesn’t merely influence the price of Bitcoin itself; it has a profound effect on the broader crypto market. Here’s a deep dive into the mechanics of Bitcoin halving and its broader implications.

Understanding Bitcoin Halving

At its core, Bitcoin halving is a predetermined event embedded within the Bitcoin protocol that slashes the reward for mining a new block by half. This event occurs approximately every four years, serving as a mechanism to curb inflation by limiting the influx of new Bitcoin into the market. So far, the mining reward has seen a decrement from 25 BTC to 12.5 BTC and, most recently, to 6.25 BTC. This progressive reduction is not just a technical tweak; it’s a pivotal event that directly impacts Bitcoin’s scarcity, value proposition, and by extension, its price.

The Halving and Bitcoin’s Price

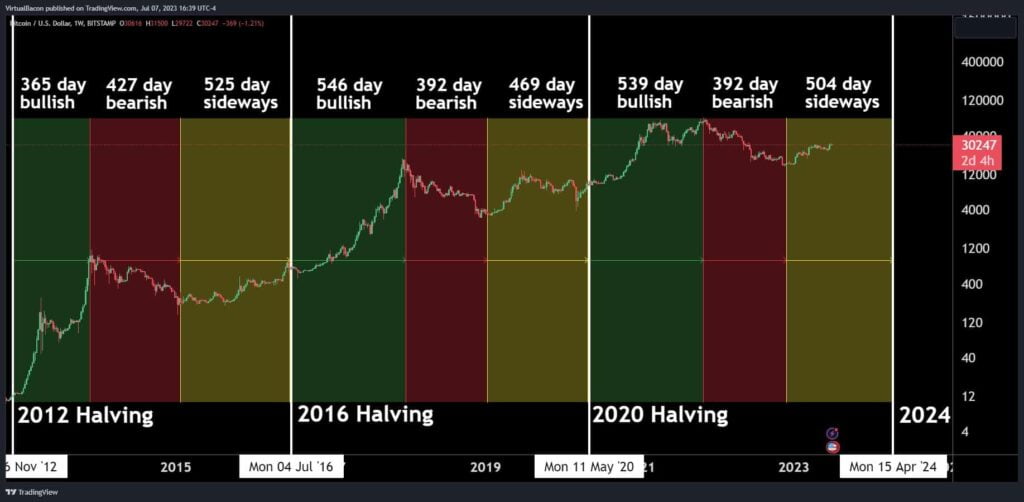

The relationship between Bitcoin halving and its price is a topic of much debate among enthusiasts and analysts alike. Historical observations suggest a pattern where the anticipation of the halving event correlates with a spike in market activity and, often, an increase in Bitcoin’s price. This pattern is attributed to the basic principles of supply and demand; as the rate of new Bitcoin entering the market slows down, the scarcity of Bitcoin increases, which, assuming demand remains constant or increases, can lead to a higher price.

However, it’s crucial to note that while historical trends provide insight, they are not a guaranteed predictor of future outcomes. A myriad of factors beyond the halving event, including regulatory changes, technological advancements, and shifts in investor sentiment, influence market dynamics.

Broader Implications for the Crypto Market

The effects of Bitcoin halving extend beyond the price of Bitcoin to influence the entire cryptocurrency ecosystem. Here are a few key impacts:

Increased Market Activity

The anticipation and speculation leading up to the halving event often result in heightened market activity. Investors and traders closely watch the event, leading to increased trading volumes and, sometimes, volatility in the price of Bitcoin and altcoins alike.

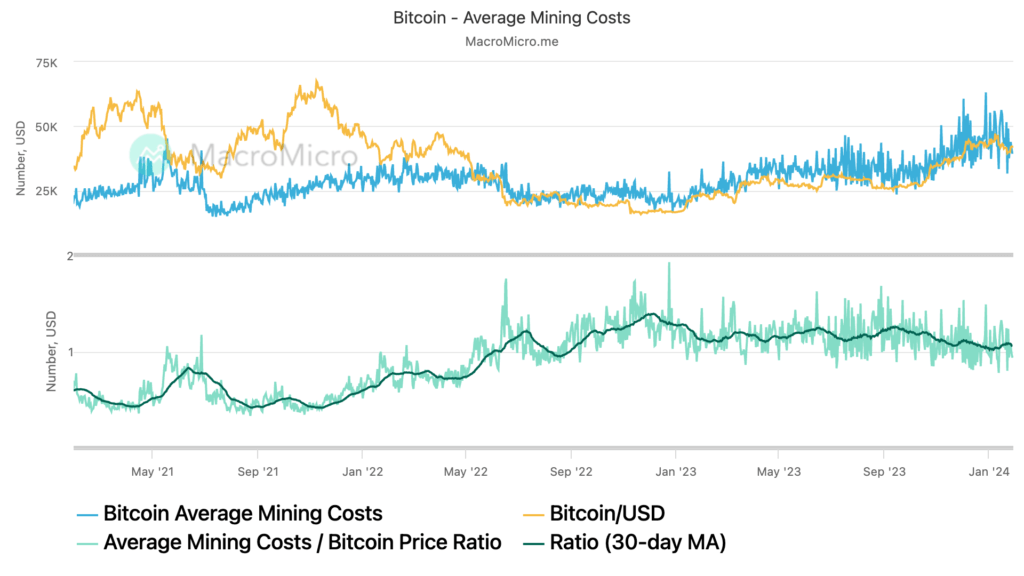

Shifts in Mining Dynamics

The reduced block reward means miners earn less for their efforts, which can lead to a reevaluation of mining operations. Less efficient miners may find it no longer profitable to continue, potentially leading to a temporary decrease in the network’s hash rate. However, this also encourages innovation and investment in more efficient mining technologies.

Influence on Altcoins

Bitcoin’s halving can have a ripple effect on the altcoin market. As Bitcoin’s scarcity increases and if its price rises as a result, it can lead to increased interest in the broader crypto market, potentially benefiting altcoins. Conversely, if the market perceives the halving negatively or if it leads to increased volatility, it could have a dampening effect on altcoin prices.

Conclusion

The upcoming Bitcoin halving is more than just an event of interest to Bitcoin enthusiasts; it’s a milestone with the potential to shape the crypto landscape. While its direct impact on Bitcoin’s price remains a subject of speculation, the event undeniably plays a critical role in influencing market dynamics, mining operations, and the strategic decisions of investors across the cryptocurrency market. As the halving approaches, staying informed and prepared is key to navigating the potential waves it may create in the crypto ecosystem.

FAQs

What exactly is Bitcoin halving?

Bitcoin halving is a scheduled event in the Bitcoin protocol that cuts the mining reward for creating a new block by half. This event occurs approximately every four years.

How does Bitcoin halving affect its price?

The effect of Bitcoin halving on its price is subject to debate. Historically, halvings have been associated with increased market activity and prices due to the reduced supply of new Bitcoins, but future outcomes cannot be guaranteed.

Will the next Bitcoin halving lead to a price increase?

While past halvings have been followed by price increases, predicting the exact outcome of the next halving is challenging due to the complex interplay of market forces.

How does Bitcoin halving impact the broader crypto market?

Bitcoin halving can lead to increased market activity and shifts in mining dynamics and can influence the prices and interest in altcoins, depending on how the market perceives and reacts to the event.